Taxes For Freelancers And Gig Workers In India | Rules, Benefits, and Liabilities

Why Should ‘YOU’ Know The Financials And Taxes For Freelancers And Gig Workers In India?

Did you know that India is the world’s second-fastest-growing freelancing market?

Even more, you are most likely to be a part of the gig economy either as a seeker or a contributor. The gig economy has always had a significant impact on our lives directly or indirectly.

Now, don’t you think it’s necessary to understand the financials and taxes for freelancers and gig workers in India?

India has experienced a rapid change in the scope of freelance work, from a sideline career choice to a vital element of the workforce.

With the rising need for specialized expertise, industries are looking for freelancers and gig workers to meet talent demand.

However, as gig workers take on these new gigs and tasks, they’re probably not thinking about the taxation of the gig economy.

This article intends to provide you with essential information about the taxes for freelancers and gig workers in India, the freelance income tax process, and how to save on tax.

Before we deep dive into the tax benefits and liabilities for gig workers, here’s a glance at gig workers and the gig economy in India.

Those aware of this can skip to – How is Freelance Income Determined?

Read on to learn more!

Who Is A Gig Worker?

A Gig is a job that lasts only for a short period.

A gig worker is a professional who receives payment based on multiple one-time projects or “gigs” in place of receiving a regular monthly income.

It creates a flexible work environment where companies pay gig workers only for the work they complete.

These are the professionals who operate in the gig economy.

What Is The Gig Economy?

A gig economy employs temporary workers for a limited period without requiring a long-term connection or contract between the client and the gig worker.

And any engagements or communication is maintained via technology or online platforms.

For instance, the article – taxes for freelancers and gig workers in India that you’re currently reading is written by a freelance content writer on Workflexi.in

Workflexi.in is an online gig marketplace that connects freelancers and gig workers with clients to provide short-term services or asset-sharing.

You can create your free account on Workflexi and showcase your skills if you’re looking for gigs.

Thanks for bearing with my one-liner promotion. Please continue enjoying your reading 🙂

– editor

As a gig worker, you can promote your skills in the unskilled labor market or as trained professionals and offer your services on various platforms or firms in the Gig Economy. It’s also known as crowdsourcing, shared economy, or collaborative economy.

This idea was first attributed to Airbnb, an online marketplace for shared rental spaces to accommodate lodging and vacations in the USA.

The gig economy encompasses all sectors that recruit freelancers like e-commerce, technology, food and beverage, and home services.

How Does The Gig Economy Work In India?

The gig economy isn’t new to India.

It has always offered temporary and quick independent jobs as part of its informal economy, estimated to be 3-7 times larger than India’s formal economy when all economic activity is included.

Companies are now inclined towards hiring gig workers due to the pandemic-induced remote working conditions.

So far, the remote working experience has blurred the old-age skepticism about the efficiency and dependability of gig workers.

According to a study, by 2025, India will have 350 million gig jobs, providing great potential for job searchers to capitalize on and adapt to shifting work dynamics.

The gig economy includes anything from temporary agricultural workers to daily wage employees, contributing largely to India’s economy in terms of person-hours and money equivalent.

The Indian Gig Economy is highlighted by companies like Workflexi (white-collared gigs), Ola (cab services), and Zomato (food delivery), which have made great strides in the shared economy, where a worker is not limited to one job or a specific time.

This tendency is soon projected to influence the gig economy considerably.

How Is Freelance Income Determined?

You earn money when you’re hired to work on a particular task for a set period and are paid once your task is completed.

Are Gigs And Freelancing Earnings Taxable?

Even though freelancing is geared toward remote-centric workers, freelancers should still adhere to tax regulations.

Any income from exhibiting your intellectual or manual abilities is considered earnings from a profession under the Income-tax Act.

This income is subjected to taxation under Profits and Gains from Business or Profession.

A freelancer’s gross income is the amount of all receipts they receive from completing gigs.

The receipts are counted regardless of where your clients come from, domestic or international, or how much they pay for your service.

To calculate the total earnings, you will need the bank statements of all transactions from the clients.

To file income taxes as a freelancer, you should show the income earned in that financial year. Your bank account acts as a record to cull out your professional income.

Now, let’s understand what constitutes taxable income, tax rules, tax benefits, and liabilities for freelancers in India.

Conditions To Claim Deductions On Expenses As A Freelancer

It’s essential to meet several conditions to determine what constitutes an expense for a freelancer.

These include:

- Expenses should be directly proportional to the amount spent on a particular task.

- You must incur expenses in the tax year.

- Capital and personal expenses are not included in the expense.

- There should not be any criminal wrongdoing involved in incurring the expense.

Expenses Claimable For Tax Deduction Against Freelance Income

Like many other tax-payers, freelancers and gig workers can also claim tax exemptions against the expenses incurred in their job. For example, cab fare expenses to visit clients.

The bottom line, the expenses incurred must be directly related to your work.

Now that you’ve understood what’s considered an expense for freelancers let’s look at the ones they can claim for tax deductions.

Freelancers can claim several deductions through the law, all of which are listed below.

1. Rental Expense

If you rent a property to run your freelance service, you can claim the rent paid

2. Expense Carried Out For Repair

You can claim deductions on costs incurred in repairing the rented property.

Owning the business property and carrying out repairs are also allowable deductions.

Likewise, you can claim deductions on your laptop, printer, and any other equipment repairs.

3. Depreciation

When you buy a capital asset, you anticipate the value to continue longer than a year. Therefore, when such assets are purchased, they are capitalized and not allocated to costs.

Instead, a percentage of the cost is charged and deducted from your yearly earnings, called the annual Depreciation charge.

For example, if you invest Rs.60,000 on a laptop for freelancing work, The laptop will be an asset.

However, assuming a straight-line depreciation of 33.33% per year, Rs.20,000 will be charged as annual expenditures, and the asset will be fully depreciated in the following three years.

According to the Income Tax Act, freelancers can consider assets, methods, and depreciation rates.

4. Office Expenses

Expenditures incurred to carry out your tasks, such as office supplies, monthly phone bills, internet bills, investment in a printer, and transportation expenses, can be claimed and deducted.

5. Travel Expenses

The expense of traveling to meet your clients within or outside of India is deductible.

6. Expenses for Meals and Entertainment

You can claim deductions when you have client meetings, take your clients out to dinner, or engage in other activities to acquire new business or retain existing clients.

7. Local Taxes and Insurance

The cost of registering a domain, hosting expenses, server expenses, salaries of other freelancers/employees, marketing expenses, or purchasing software tools are also claimable.

When assets are claimed or expenses incurred for professional and personal reasons, only a fair portion of the expenses and depreciation can be deducted, not the entire amount.

Should Freelancers File TDS?

TDS or Tax Deducted at Source is a specific amount deducted from payments such as salary, commission, rent, interest, or professional fees.

The person who makes the payment deducts tax at the point of sale (POS), but the person who gets the payment/income must pay tax.

It minimizes tax evasion because the tax is collected at the moment of payment.

When submitting ITRs (Income Tax Returns), freelancers can claim the deducted TDS and obtain information regarding the TDS deducted via Form 26AS.

TDS is deducted at a rate of 10% anytime a freelancer or a small business owner pays professionals more than Rs.30,000 each transaction or in total for a financial year.

Moreover, freelancers can only deduct TDS if they have been audited for the previous financial year.

Freelancers will only be audited if their annual gross receipts exceed Rs 50 lakh, and TDS won’t be applicable in this scenario.

Taxable Income For A Freelancer

The following formula is used to compute the taxable income, determined by the amount of money earned and the tax bracket each person falls.

Total Taxable Income = Gross Taxable Income – Deductions

Freelancers can also claim deductions of up to Rs.1,50,000 under Section 80C of the Income Tax Act if they invest a specified amount for savings.

Tax Payable As A Freelancer

If a freelancer’s responsibility for a given financial year exceeds Rs.10,000, they are liable to pay taxes every quarter. It is referred to as Advance Tax.

How To Calculate Advance Tax?

The following are the steps to be followed by freelancers to calculate advance tax.

- Calculate the freelancer’s total income by adding all the invoices and receipts.

- Eliminate the expenses that are directly tied to the freelancer’s work. These can include internet bills, travel expenses, and other things listed in the claimable expenses section.

- You should include income from other sources, including a savings account.

- Determine the tax slab in which you fall and calculate the tax due.

- Minus the Tax Deducted at Source (TDS).

- The freelancer should pay an advance tax if the tax due exceeds INR 10,000 by the below dates.

Advance Tax Due Dates

The due dates to pay advance tax by freelancers are as follows –

| Advance Tax Due Dates | Advance Tax Payable |

| On or before 15th June | 15% |

| On or before 15th September | 45% |

| On or before 15th December | 75% |

| On or before 15th March | 100% |

How To Pay Advance Tax?

You can do it in two ways.

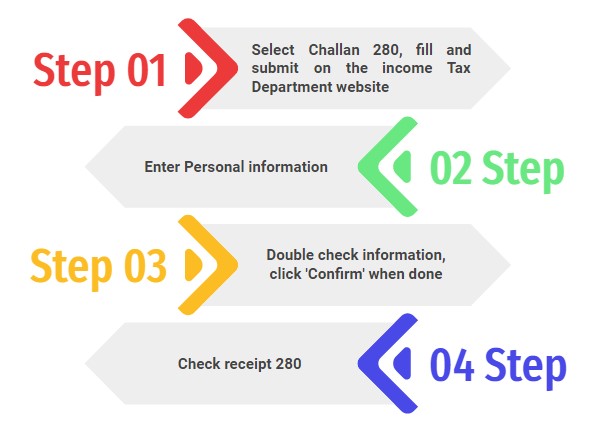

1. You can pay online through the IT Department’s website by following the steps below-

2. The tax can also be deposited physically at your bank by filling out a paper challan.

Advance Tax Penalties

When freelancers fail to pay advance tax, they are responsible for the interest described in Sections 234B and 234C.

To avoid these penalties, the following must be considered when calculating freelancers’ income tax liability.

- If a freelancer’s tax due exceeds INR 10,000 in a year, they should pay advance tax.

- Freelancers should make the whole Advance Tax payments by 31st March of each year; this includes 100% of the total tax due.

If a freelancer fails to pay Advance Tax by the deadlines provided by the Internal Revenue Service (IRS), penalties under Section 234B will apply.

The penalties under Section 234C will also apply if the freelancer fails to pay the interest accumulated according to the established due dates.

GST For Freelancers

Freelancers were previously liable to VAT and Service Tax. The GST has now replaced these taxes.

Freelancers whose turnover is more than 20 lacs and who offer services outside their state need to register for GST.

The percentage of GST for a freelancer depends on the kind of service the freelancer provides. If no rate is specified, the freelancer is liable for 18% GST.

When You Sell Goods

The GST rate will be determined by the things you sell.

For example, if you bake and sell cakes, you must charge 18% GST. Currently, this is the GST rate that applies to cakes.

When You Offer A Service

Most services are subject to an 18% GST. As a result, you must charge clients 18% GST for your freelancing services.

Points To Remember Under GST For Freelancers

- GST will be levied to the other GST tax-payer if the total revenue from freelancing employment exceeds Rs 20 lacs.

- You should be eligible for the composition scheme in case you sell goods

- The composition approach does not apply in the case of services. However, you can make interstate supplies up to the value of Rs 20 lacs without registering for GST.

- Your invoice should be from the GST complaint.

GST Invoice Process

When billing clients for their services, freelancers should include a GST invoice.

Experts recommend using online accounting software to receive accurate GST invoices for each task.

The following elements are required to be included in your invoice –

- Your name, address, and GST number

- Client’s name, address, and GSTIN, if applicable

- Invoice number and date of invoice

- Invoice due date, if applicable

- The value of the service and the tax rate

- Signature

To Sum Up

Freelancers work on different assignments for domestic and international clients. Therefore, the computation of taxes for freelancers and gig workers in India can be confusing.

In such a scenario, it’s recommended to consult a professional Certified Public Accountant to ensure you’ve taken advantage of all legal tax deductions and are getting the most out of your return.